Here's an uncomfortable truth: 81% of B2B buyers have already chosen their preferred vendor before they ever talk to sales. They're deep into research, evaluating your competitors, comparing ecosystems, and making decisions while you're still waiting for that first demo request.

And where are they looking? At your partner ecosystem. Or at least, they're trying to.

The problem is that most B2B companies treat their partner ecosystems like classified information. They bury partner lists in PDFs, hide them behind contact forms, or scatter them across disconnected pages that Google can't even index. Meanwhile, their buyers are actively searching for integration capabilities, implementation partners, and ecosystem proof points.

This isn't a marketing problem. It's an infrastructure problem. And in 2026, it's going to separate the companies that grow from the ones that get left behind.

Partner marketplaces aren't just directories. They're revenue infrastructure that makes your ecosystem discoverable, measurable, and scalable. Here's how to build one that actually works.

Why Partner Marketplaces Matter Now

The B2B buying process has fundamentally changed. Buyers don't want to talk to your sales team until they've done their homework. In fact, 77% won't even speak to sales until they've completed their own research. They're comparing you against competitors, reading reviews, checking integrations, and evaluating your partner ecosystem before you even know they exist.

And here's what matters: 90% of B2B buyers say a vendor's ability to integrate with their existing tech stack is critical to their decision. Not important. Not nice to have. Critical.

This explains why 82% of corporate boards are actively investing more in partnership strategies. They're seeing what the data shows: companies embracing Ecosystem-Led Growth demonstrate a 24% higher likelihood of hitting their revenue targets. The integrated network economy is projected to reach $70 trillion by 2030, representing 25% of the total global economy.

But here's the disconnect: most companies have strong partner ecosystems but keep them invisible. They're investing in partnerships while simultaneously hiding them from the buyers who are actively looking for exactly that information.

Partner program invisibility isn't a symptom of underperformance. It's the cause. When buyers can't find your partners during their anonymous research phase (which is when they're actually making decisions), you've already lost the deal. You just don't know it yet.

The companies building proper partner marketplace infrastructure in 2026 aren't just improving their partner programs. They're building competitive moats while their competitors are still treating partner pages as an afterthought.

The Three Layers of Partner Marketplace Infrastructure

Think of partner marketplaces as infrastructure with three distinct layers. Each layer builds on the one before it, and missing any layer means you're leaving serious revenue on the table.

Layer 1: Discoverability

This is where most companies fail before they even start. They create partner pages that are invisible to search engines and impossible for buyers to navigate.

Discoverability means SEO-optimized partner directories where each partner gets their own dedicated page with proper schema markup, relevant keywords, and content that actually answers buyer questions. Not a list. Not a PDF. Individual, searchable, indexable pages.

What discoverability looks like in practice:

Individual partner pages with unique URLs (not dynamic parameters)

Schema markup for organizations, integrations, and software applications

Keyword optimization for buyer search intent ("Salesforce implementation partner Boston")

Category pages targeting integration searches ("payment gateway integrations," "CRM connectors")

Proper internal linking between partner pages and product documentation

Mobile-responsive design that loads in under 3 seconds

XML sitemaps submitted to search engines for faster indexing

When someone searches "Salesforce implementation partner in Boston" or "payment gateway integration for HR software," your partner marketplace should appear in those results. That's programmatic SEO working for you 24/7, capturing buyer intent at exactly the moment it matters.

Static partner pages buried three clicks deep don't count. Partner portals behind login walls don't count. PDFs definitely don't count. If Google can't crawl it and buyers can't find it, it's not infrastructure.

Layer 2: Measurability

Here's where cross-functional alignment becomes critical. Marketing wants to track influenced pipeline. Sales wants to see deal velocity. Customer Success wants retention data. Product wants integration adoption metrics. Partnerships wants partner engagement.

They're all right. And they all need different things from the same partner marketplace.

The second layer of infrastructure is attribution and analytics that actually work across these functions. When a prospect views your partner marketplace, clicks through to a specific integration partner, and then converts three weeks later, every team needs to see that data through their own lens.

This matters more than you think. Leadership teams expecting partner-influenced revenue to grow over 30% year-over-year (which is 67% of them, by the way) need proof that their ecosystem is actually driving results. Anecdotes about "strong partner relationships" don't cut it anymore when CFOs are demanding data.

Measurability turns your partner marketplace from a marketing asset into a revenue engine with clear attribution, trackable influence, and cross-functional visibility into what's actually working.

Layer 3: Scalability

Manual updates don't scale. Neither does asking your partnership team to maintain hundreds of partner profiles, keep integration data current, or manually match prospects with relevant partners.

The third layer is where AI and automation transform partner marketplaces from static directories into intelligent platforms. This includes AI-powered partner matching based on buyer intent, automated profile updates pulled from integration data, dynamic content recommendations, and network effects that get smarter as your ecosystem grows.

Platforms like Bonobee automate this entire layer, turning what used to require constant manual maintenance into self-optimizing infrastructure. When you're managing 50+ partners (or 200+ partners), AI isn't optional. It's the only way to maintain quality at scale while your team focuses on strategy rather than spreadsheet updates.

The companies treating scalability as "nice to have" are the same ones that will hit a ceiling at 30-40 partners because manual processes simply can't keep up. The companies building scalable infrastructure from day one are the ones capturing the 84% CAGR growth in digital marketplace adoption.

Partner Marketplace Infrastructure: A Comparison

Layer | Traditional Approach | Infrastructure Approach | Business Impact |

|---|---|---|---|

Discoverability | Static PDF partner lists, buried partner pages, no SEO optimization | Individual partner pages, programmatic SEO, schema markup, searchable directories | Capture buyer intent during anonymous research phase, rank for integration searches |

Measurability | Partnership team tracks "relationships," no cross-functional visibility | Attribution across Marketing, Sales, CS, Product; partner-influenced pipeline tracking | Prove ROI to leadership, optimize partner performance, align teams on outcomes |

Scalability | Manual profile updates, spreadsheet management, limited to 30-40 partners | AI-powered matching, automated updates, network effects, hundreds of partners | Manage ecosystem growth without headcount growth, intelligent recommendations |

Building Your Partner Marketplace: The Practical Framework

Stop treating partner marketplaces like year-long projects. With the right approach, you can launch meaningful infrastructure in weeks, not months. Here's the framework that actually works.

Phase 1: Foundation (Week 1)

Start with an honest audit of your current partner program visibility. Open an incognito browser and search for your company name plus "partners" or "integrations." What do you find? A PDF? A generic partner page? Nothing?

Now search for your competitors. If they have discoverable partner marketplaces and you don't, you're already behind.

Next, define cross-functional requirements. Marketing needs SEO and lead attribution. Sales needs partner referral data and co-selling visibility. Customer Success needs implementation partner information and support escalation paths. Product needs integration documentation and API partner data. Partnerships needs partner engagement metrics and program analytics.

Write these down. Every single one. Because a partner marketplace that only serves one function is going to create more problems than it solves.

Finally, make the build vs. buy decision. Custom builds take 6-12 months and rarely deliver what you actually need. White-label solutions are faster but often lack the AI and automation you need for Layer 3. Purpose-built platforms offer the fastest path to all three layers of infrastructure.

Phase 2: Structure & Content (Week 2)

Partner data architecture is where most projects either nail it or struggle forever. You need a clear taxonomy that makes sense to buyers, not just to your internal teams.

Think about how buyers actually search. They're not looking for "Technology Partners" versus "Services Partners." They're searching by use case ("payment processing for SaaS"), by integration type ("CRM integrations"), by geography ("implementation partners in EMEA"), or by industry ("fintech compliance solutions").

Your structure needs to support all of these search patterns simultaneously.

For individual partner pages, the content architecture matters. Each page needs: partner description and value proposition, specific integration capabilities and use cases, implementation approach and timeline expectations, customer success stories (when available), geographic coverage and industry expertise, and clear next steps for both buyers and partners.

This isn't about writing novels. It's about giving Google (and buyers) enough signal to understand what this partner actually does and why they matter.

Integration points with your existing tech stack are non-negotiable. Your partner marketplace needs to pull data from your CRM, push leads to your marketing automation platform, sync with your partner portal (if you have one), and feed analytics to your business intelligence tools.

Phase 3: Launch & Activation (Week 3-4)

Internal stakeholder alignment happens before launch, not after. Marketing needs to understand how to drive traffic to the marketplace. Sales needs to know how to reference partners during deals. Customer Success needs to know which partners solve which problems. Partnerships needs to know how to activate partners within the marketplace.

Run alignment sessions with each team. Show them exactly how the marketplace serves their specific needs. Get their buy-in on metrics and KPIs. Because a partner marketplace that leadership doesn't understand or use becomes a ghost town fast.

Partner onboarding is where many companies stumble. They build a beautiful marketplace and then realize they need 50+ partners to complete detailed profiles. Do this before launch. Give partners clear templates, concrete examples, and specific deadlines. Make it easy for them to look good.

Search optimization starts on day one. Submit your sitemap to Google Search Console. Implement proper schema markup for organizations and integrations. Build internal linking between partner pages and relevant product pages. Create content that targets the search terms your buyers are actually using.

Don't wait for "enough traffic" to start optimizing. Start optimizing to get traffic.

Phase 4: Optimization & Scale (Ongoing)

This is where companies embracing Ecosystem-Led Growth pull away from everyone else. They're seeing that 24% higher likelihood of hitting revenue targets because they're treating partner marketplaces as living infrastructure, not static websites.

AI-powered partner matching gets smarter as you collect more data. When a fintech company visits your marketplace and spends time on payment processing pages, the platform should automatically surface relevant payment partners. When an enterprise prospect views compliance integrations, those partners should be prioritized.

Analytics implementation goes deeper than pageviews. Track partner page engagement by account tier. Measure time between marketplace visit and deal close. Identify which partners drive the highest conversion rates. Understand which integration categories generate the most pipeline influence.

Continuous SEO refinement means monitoring which search terms drive traffic, which partners rank for valuable keywords, and where you're missing opportunities. Partner marketplaces should improve their search visibility monthly, not yearly.

Partner ecosystem expansion becomes natural when your marketplace is working. Partners want to be featured where buyers are actually looking. The infrastructure you've built makes it easy to add new partners, new integration categories, and new use cases without rebuilding everything.

Implementation Timeline: From Launch to Scale

Phase | Timeline | Key Deliverables | Success Metrics |

|---|---|---|---|

Foundation | Week 1 | Partner visibility audit, cross-functional requirements doc, platform decision | Stakeholder alignment achieved, clear requirements documented |

Structure & Content | Week 2 | Partner taxonomy, SEO-optimized templates, tech stack integrations | Partner pages indexed by Google, schema markup implemented |

Launch & Activation | Weeks 3-4 | Internal training, partner onboarding, search optimization, go-live | Marketplace live, 80%+ partner profiles complete, search rankings tracking |

Optimization & Scale | Ongoing | AI matching, analytics dashboard, SEO refinement, ecosystem growth | Partner-influenced pipeline tracked, search traffic growing monthly, partner satisfaction high |

What Makes a Partner Marketplace Actually Work

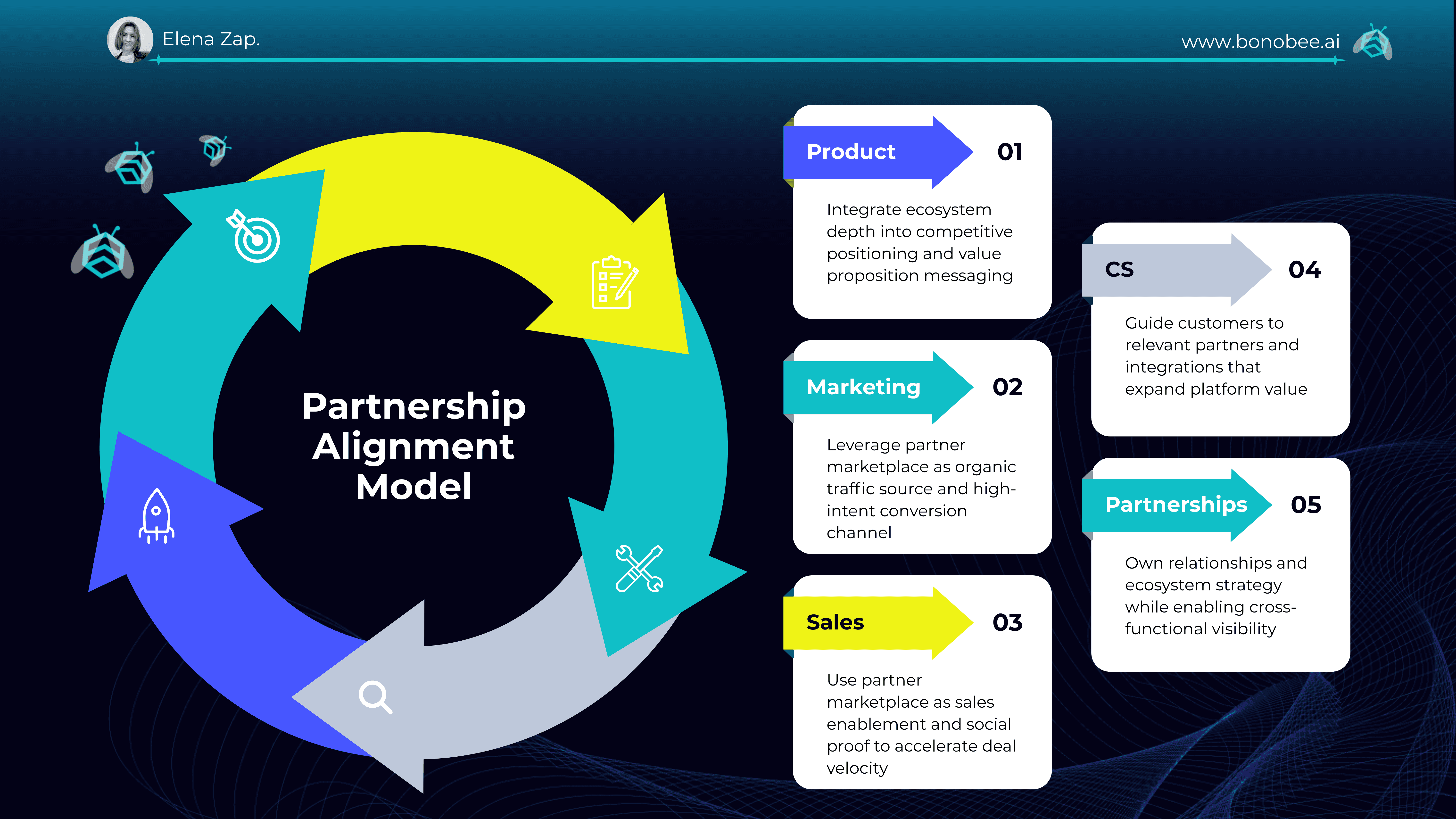

Cross-functional ownership is the difference between a partner marketplace that drives revenue and one that sits unused. Partnerships can't own this alone because they don't control marketing traffic, sales processes, product integrations, or customer success workflows.

The most successful partner marketplaces have clear ownership: Partnerships owns partner relationships and program structure, Marketing owns traffic and SEO, Sales owns deal integration and referral process, Product owns integration documentation and technical accuracy, Customer Success owns implementation partner coordination.

Everyone owns outcomes. No one owns it alone.

Cross-Functional Partner Marketplace Ownership

Function | Primary Responsibilities | Key Metrics | Common Pitfalls to Avoid |

|---|---|---|---|

Partnerships | Partner recruitment, relationship management, program structure, partner enablement | Partner engagement score, active partner count, partner satisfaction | Trying to own marketplace alone, focusing only on relationships not revenue |

Marketing | SEO strategy, traffic generation, content creation, lead attribution, brand consistency | Organic search traffic, partner page rankings, influenced pipeline | Treating as one-time launch project, ignoring ongoing SEO needs |

Sales | Partner referrals, co-selling coordination, deal integration, revenue attribution | Partner-influenced deals, co-sell win rate, partner referral conversion | Not understanding partner value props, skipping partner mentions in demos |

Product | Integration documentation, API partner support, technical accuracy, feature roadmap alignment | Integration adoption rate, API partner count, technical support tickets | Outdated integration docs, missing partner in product roadmap discussions |

Customer Success | Implementation partner coordination, support escalation, retention through ecosystem | Partner-led implementations, ecosystem expansion revenue, customer satisfaction | Not knowing which partners solve which problems, manual partner matching |

Everyone owns outcomes. No one owns it alone.

Content depth separates real partner marketplaces from directories. A list of logos with links doesn't help buyers make decisions. They need to understand what each partner does, how they work with your platform, which use cases they solve, and why they should care.

Integration with the buyer journey means your partner marketplace appears at the right moments. When prospects are evaluating your product, partner integrations should be visible in your comparison pages. When they're ready to implement, partner services should be front and center. When they're expanding usage, new integration possibilities should surface automatically.

The role of AI in modern partner marketplaces is transformation, not incrementalism. AI handles partner matching based on buyer behavior, content recommendations based on industry or use case, automated profile updates from integration data, and predictive analytics for partner performance.

This isn't futuristic. Bonobee and similar platforms are already doing this. The question is whether you're building marketplaces with this capability or without it.

Mobile and search optimization are table stakes. Over 60% of B2B research happens on mobile devices. If your partner marketplace doesn't work perfectly on phones and tablets, you're losing buyers before they ever reach your sales team.

Common Mistakes and How to Avoid Them

Mistake #1: Treating partner marketplaces as marketing projects instead of infrastructure

Marketing projects have launch dates and completion criteria. Infrastructure requires ongoing investment, cross-functional ownership, and long-term commitment. The fix: Get executive buy-in for partner marketplace as revenue infrastructure, not a campaign. Budget for ongoing optimization, not just a one-time build.

Mistake #2: Building partner marketplaces without SEO architecture

Beautiful design means nothing if nobody can find it. SEO isn't something you add later, it's foundational to taxonomy, URL patterns, content architecture, schema markup, and internal linking. The fix: Start with keyword research and buyer search intent. Build your structure around how people actually search, not how your internal teams think about partners.

Mistake #3: Launching without cross-functional buy-in

Sales won't reference partners they don't understand. Marketing won't drive traffic to pages they don't control. Customer Success won't recommend implementation partners they haven't vetted. The fix: Run alignment sessions with each team before launch. Show them exactly how the marketplace serves their specific needs. Get buy-in on metrics and KPIs.

Mistake #4: Static directories that require manual updates

The moment a partner changes their service offering, updates their geographic coverage, or adds new integration capabilities, your marketplace is out of date. And once it's out of date, partners stop caring and buyers stop trusting. The fix: Build automation from day one. Use platforms with API integrations that pull partner data automatically. Invest in AI-powered updates.

Mistake #5: Ignoring measurability from day one

You can't improve what you can't measure. You can't defend budget for what you can't quantify. The fix: Implement analytics in your foundation, not as an afterthought. Track partner page engagement by account tier, measure time between marketplace visit and deal close, identify which partners drive the highest conversion rates.

Key Takeaways: Building Partner Marketplace Infrastructure

How long does it take to build a partner marketplace?

With the right platform approach, you can launch a functional partner marketplace in 2-4 weeks. Custom builds typically take 6-12 months and often miss critical features like AI matching and automated updates.

What's the difference between a partner directory and a partner marketplace?

Partner directories are static lists of logos and links. Partner marketplaces are SEO-optimized, searchable platforms with individual partner pages, integration details, use case content, and measurable attribution that drives actual revenue.

Do I need a developer to build a partner marketplace?

Not if you use purpose-built platforms like Bonobee that handle the technical infrastructure, SEO optimization, and AI automation. Custom builds require significant development resources and ongoing maintenance.

How do you measure partner marketplace success?

Track organic search traffic to partner pages, partner-influenced pipeline, time from marketplace visit to conversion, partner page engagement by account tier, and revenue attributed to ecosystem discovery.

What makes partner ecosystems discoverable?

Individual SEO-optimized pages for each partner, proper schema markup, keyword-targeted content, category pages for integration types, internal linking to product pages, and programmatic SEO for scale.

Your 2026 Ecosystem Positioning

Here's what's happening right now: B2B buyers are evaluating partner ecosystems before they talk to sales. They're making decisions based on integration capabilities. They're choosing vendors with visible, discoverable, professional partner marketplaces over competitors with PDFs and static pages.

And they're doing all of this during the anonymous research phase where you have zero visibility unless your infrastructure is working for you.

The timeline reality is simple. You can build meaningful partner marketplace infrastructure in two weeks with the right platform. Or you can spend the next year trying to coordinate a custom build while your competitors capture the buyers who are searching right now.

Digital marketplace adoption grew at an 84% CAGR over the past five years. This isn't a trend you can wait out. It's a fundamental shift in how B2B buying works.

The companies building partner marketplace infrastructure in 2026 aren't just improving their partner programs. They're creating sustainable competitive advantages that compound over time. Better SEO rankings. Stronger partner relationships. Higher conversion rates. More attributed revenue.

The companies waiting for "the right time" are falling further behind every quarter.

If you're ready to make your partner ecosystem actually discoverable, measurable, and scalable, the infrastructure exists to do it right now. Platforms like Bonobee can have you live with a working partner marketplace in weeks, not months.

Your buyers are already looking for your partners. The question is whether they'll find them.

Ready to build partner marketplace infrastructure? Learn more about how Partner2B helps B2B companies transform their partner ecosystems from hidden assets into revenue engines.